Services

Our Services

BluSky is a national restoration contractor with locations coast to coast. We provide commercial, industrial, governmental, and multifamily restoration, renovation, environmental, and roofing services across the U.S.

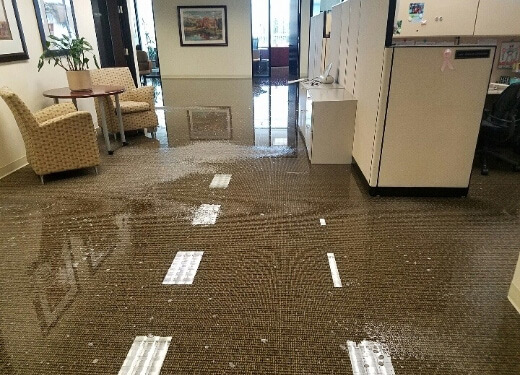

Water Damage Restoration

It’s crucial that the water damage restoration process is handled properly in order to avoid future mold issues.

Learn More

Fire Damage Restoration

The damage caused by fires doesn’t end when the flames have been extinguished.

Learn More

Storm Damage Restoration

Hurricanes, tornadoes, heavy winds, rain, hail, ice and snow buildup can cause some serious damage. We’re here to help.

Learn More

Cleaning & Disinfecting Services

A disaster can strike your property with little or no warning, stressing your on-site management team disrupting everything.

Learn More

Environmental Services

Our internal environmental specialists are certified to work under extremely hazardous conditions

Learn More

Commercial Roofing Services

BluSky’s in-house Commercial Roofing Division approaches large loss differently… so should you.

Learn More